Deciding whether to rent or buy a house is one of the most important financial decisions you’ll make. It’s a question that many people face, and the answer isn’t always straightforward. With housing markets fluctuating and personal circumstances playing a significant role, there’s no one-size-fits-all solution. To make the best choice, you’ll need to weigh various factors, including your financial situation, personal preferences, long-term goals, and overall lifestyle.

For lots of people, buying a house is the largest financial risk they’ll ever take. It’s also usually their largest financial asset. That’s why understanding the true cost of home ownership is essential to making the decision to rent or buy a house.

1. Understanding the Costs: Renting vs. Buying

One of the most significant factors in deciding whether to rent or buy is the cost. Let’s break it down.

- Renting Costs: When renting, you’re typically responsible for a monthly rent payment, renter’s insurance, and some utilities. Landlords cover major repairs and maintenance, so there’s less out-of-pocket expense for unexpected home-related issues. The cost of renting includes:

- Security deposit (usually 2-3x the rent, and it may be refundable)

- Pet deposit (if applicable and is usually not refundable)

- Application fee (usually $50-$150)

- Utility deposits (varies depending on region and company)

- Renter’s insurance

- Buying Costs: Buying a house, on the other hand, comes with more upfront and ongoing costs. These include:

- Closing costs (2-5% of the loan amount)

- Property taxes (varies by region)

- Homeowners insurance

- Mortgage interest payments

- Maintenance and repair costs

- HOA fees (if applicable)

- Private Mortgage Insurance (PMI) if putting less than 20% down

- Inspections and appraisals ($1000-$3000)

- Buying Investment: When you buy a house, some of what you pay is a cost (i.e. money that goes from you to someone else), and some of what you pay is an investment (i.e. money that goes towards your principal balance and you can expect to get back when you sell your home or use a home equity loan). These include:

- A down payment (typically 3-20% of the home’s price)

- Mortgage principal payments

- High ROI improvements

2. Flexibility vs. Stability

Your lifestyle and future plans also play a huge role in whether you should rent or buy a home.

- Renting offers flexibility. If your job requires you to move frequently or you’re unsure about settling in a particular city or neighborhood, renting allows you the freedom to move with ease. Short-term leases or month-to-month agreements can accommodate changing situations. But on the other hand- renting at first means you will move twice, which will mean twice the hassle and twice the expense (especially if you plan on using a storage unit).

- Buying offers stability. Homeownership is ideal for those who want to put down roots and are planning to stay in one location for at least five years. Owning a home means you’re in control — you can renovate, decorate, and create a space that truly feels like yours. In most cases- the extra cost associated with homeownership is usually made up for in home equity around year 5. Of course this depends on a lot of different factors.

3. Building Equity vs. Freedom from Maintenance

- Equity: One of the biggest advantages of buying a home is the potential to build equity. As you pay off your mortgage, you increase your stake in the property. Over time, the value of your home may also appreciate, adding to your financial net worth. Renting, on the other hand, does not build equity; your monthly payments go to the landlord without adding to your wealth. The way I see it is if you have to pay for a roof over your head one way or another- I’d rather invest in my own home than pay off a home for someone else.

- Maintenance Freedom: When you rent, the landlord typically handles all repairs and maintenance, making it a hassle-free option. As a homeowner, you’ll be responsible for all repairs, which can sometimes be costly and time-consuming. You’ll want to make sure you’re putting aside money for costly home upgrades- especially if you know they’re coming (like when you buy a fixer-upper).

4. Financial Considerations

- Renting may be ideal if you’re in a financial situation where saving for a down payment seems difficult, or if you have other financial priorities like paying off debt or saving for retirement. Renting doesn’t require a large upfront investment, making it easier to plan your budget. On the other hand- rental rates can change at any moment and you may be stuck having to move if you can’t afford the rental increases.

- Buying is a good option if you have enough savings for a down payment and an emergency fund. One quick thing I’d like to note here is that it’s a common misconception that you need a 20% down payment to buy a house. Many government backed loan programs allow homebuyers to put as little as 0% down, like with a VA or USDA loan, and as little as 3.5% with FHA loans.

5. Market Conditions

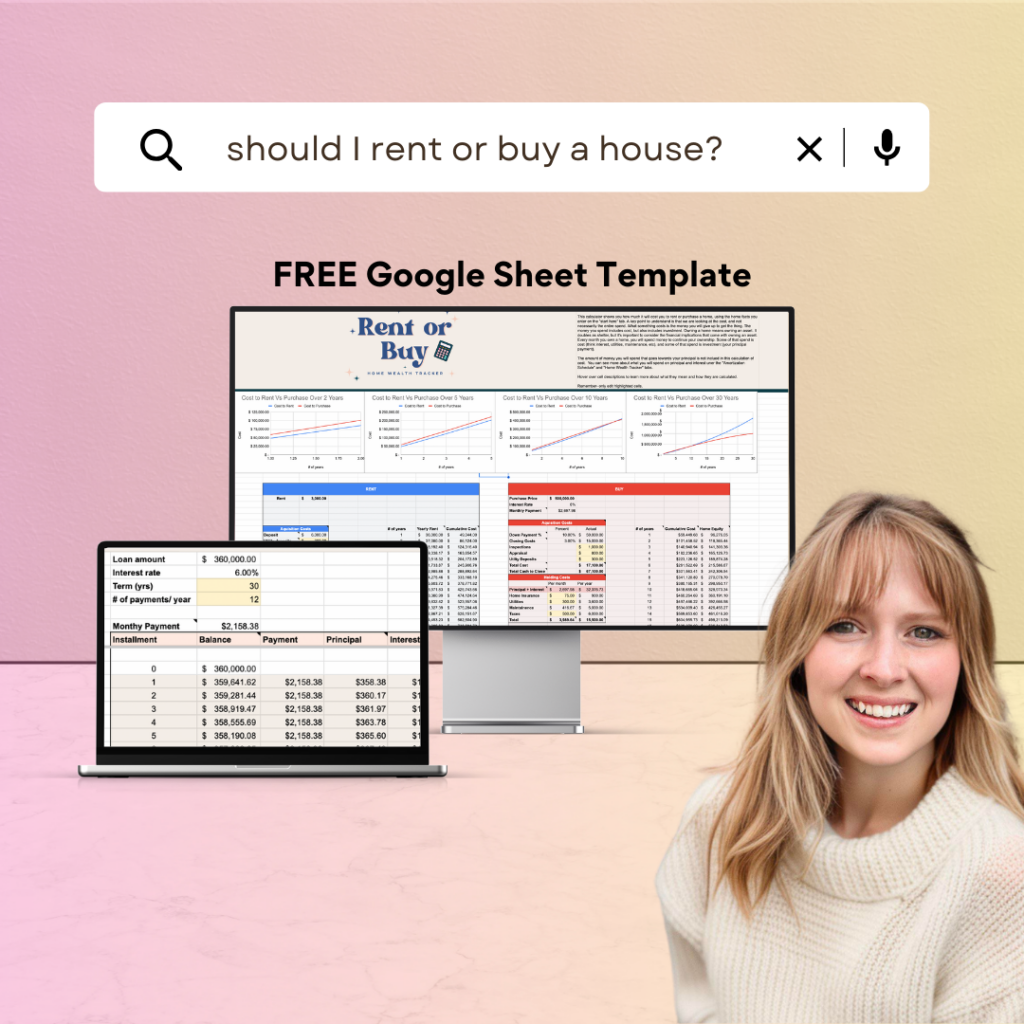

Real estate markets vary significantly depending on location. In some areas, renting may be more affordable than buying, while in others, owning a home could offer more long-term financial benefits. Understanding your local housing market and whether home prices are trending up or down can help you make a more informed decision. Spend some time surfing a home search site and get an idea of your local price points. You can compare the cost of each by plugging in a home purchase price and a monthly rental rate in the Rent vs. Buy Calculator.

6. Personal Goals

What are your long-term plans? If your goal is to build wealth and you’re ready to invest in a property, buying could be a better fit. However, if you prioritize flexibility and want to avoid the responsibilities of homeownership, renting may align more with your current goals.

Is Renting or Buying Right for You?

There’s no universal answer to whether you should rent or buy a house, as it depends on your individual situation. Take the time to assess your finances, lifestyle, and goals. If flexibility and lower upfront costs are your priority, renting could be the right choice. On the other hand, if you’re seeking stability and want to invest in your future, buying a home may be the way to go.

Ultimately, the key is to make an informed decision based on your current and future needs. By considering the pros and cons of both renting and buying, you’ll be better equipped to choose the option that fits your life best.

Should I Rent or Buy a House?